A regular review of your accounts can help you identify problems before they get out of hand. Reconciling your account also helps you identify account management or administrative issues that need attention. Performing reconciliation on a regular basis assists in the verification of flaws in the accounting documents of the organization as well as help in consistently tracking the cash flow of the company. Most of the time balances in books of vendor and customer is different. Accounting reconciliation is a way to keep the balances in a synchronise.

If there is to be reconciliation, first there must be truth.

Primarily, there are two ways to reconcile an account: Reviewing documents and Reviewing analytics;

Documentation Review

Documentation review is a common process of accounting reconciliation. This process reviews the appropriate amount for each transaction and determines whether the balance in the account matches the actual amount spent.

Analytics Review

Analytics review is another common process that individuals or business can use for reconciling an account. Under this process, businesses estimate the actual balance that should be in the accounts based on previous account activity levels. This process is important for businesses to check for fraudulent activity or balance sheet errors.

Reconciliation can benefit a company in following ways;

Eliminates accounting errors

Example – Accounting reconciliation on monthly basis is a great way to keep your bookkeeping identical to what is recorded at your bank or financial institution. It can help catch errors, which can easily happen on either side. And ultimately it will help eliminate those errors and keep them from happening again.

Keeps surprises from hitting your account

Example – Suppose you pay a check to a vendor and that vendor delays cashing it for months and months. Would you even remember that it was going to be deducted from your business account? If you reconcile your account each month, you can keep track of all transactions. Even ones that might be delayed.

Keeps your business account balances correct

Example – Human error can lead to deposit errors at your bank, which could have dire effects on your business and reputation. Imagine being short of cash in an important account that pays a portion of your expenses? Monthly accounting reconciliation can keep it from happening. Which leads to our next benefit regarding your bills.

Keeps your bills paid

Example – If you have bills and expenses that are automatically deducted from any of your accounts, then keeping track of all transactions and reconciling balances each month can keep you from having an overdraft or missing a payment.

Best Time to Reconcile

It’s wise to review your accounts at least monthly. For high-volume businesses or situations with a higher risk of fraud, you may need to reconcile your transactions even more often.

Why Need Reconciliation?

- Finding actual balance in accounts

- Inspect fraudulent activity and to prevent financial statement errors

- Highlight delay in clearance of check

- Discourages embezzlement or frauds

- Improved internal control over the company’s cash

- Difficult to compare multiple transactions

- Susceptible to a countless of errors

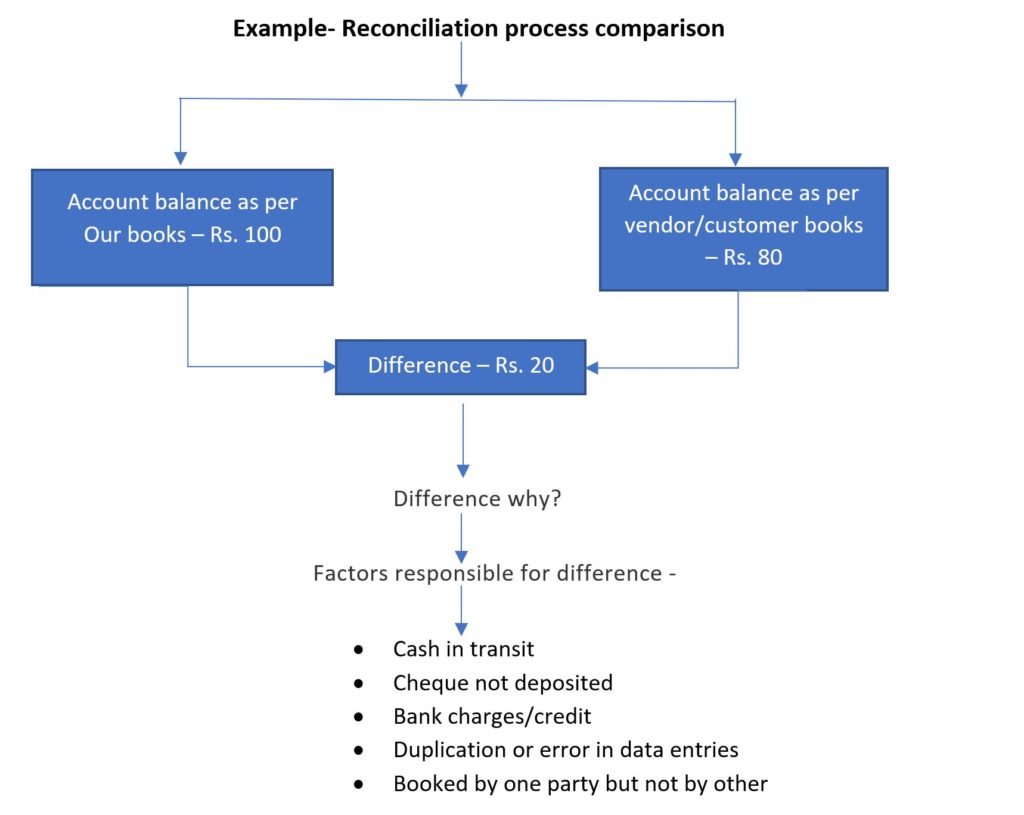

Example- Reconciliation process comparison

Work to stop something from happening is easier and better than having to try to resolve it later.

Catch Fraud Before It’s Too Late

Make any signs of fraud your priority when reconciling the transactions made in your bank account –

- Were legitimate checks that you issued duplicated or changed, resulting in more money leaving your checking (Bank/cash) account?

- Were cheques issued without authorization?

- Are there unauthorized transfers out of the account, or has anybody made unauthorized withdrawals?

- Does the account have any missing deposits?

Ankush Lohiya Senior Consultant